2019 RDTOH Planning, Don’t be Scared

2019 RDTOH PLANNING, DON’T BE SCARED Halloween came early this year, with the 2018 Federal Budget in February confirming the government’s intent to address investment income earned within a Canadian controlled private corporations (CCPC) by targeting the Refundable Dividend Tax On Hand (RDTOH) regime. RDTOH is created from passive income streams (dividends, interest, capital gains) earned by […]

Are We On The Cusp of Major Reform?

ARE WE ON THE CUSP OF MAJOR REFORM? Living in BC in the year of 2018 one cannot help but balk at the high real estate prices and costs of living in one of the most beautiful places on the planet. Due to local populist pressure, the provincial government has intervened with significant regulation and […]

Multiple Wills in B.C.

MULTIPLE WILLS IN B.C. Coming back from summer, one does not usually start thinking about their will or the need for one. In my case as a certified tax geek, having just recently been married, the first thing my mind turned to was establish a pragmatic will and life insurance for my beautiful blushing bride. […]

Do You Know Your Company’s Cash Burn Rate?

“What is your company’s cash burn rate?” is one of the first questions I ask new clients, who are between their start-up and business maturity phase. Although some have a very good understanding based on their insights to daily operations, the majority typically do not have a response and give me that deer-in-the headlights look. […]

DENTISTRY AND GST

Dentists are in an interesting position when it comes to GST. The services you offer lands you into one or more of three possible tax categories. The value of understanding this structure allows you the opportunity to recover some of the GST you pay on their purchases. Most businesses can recover the GST they pay […]

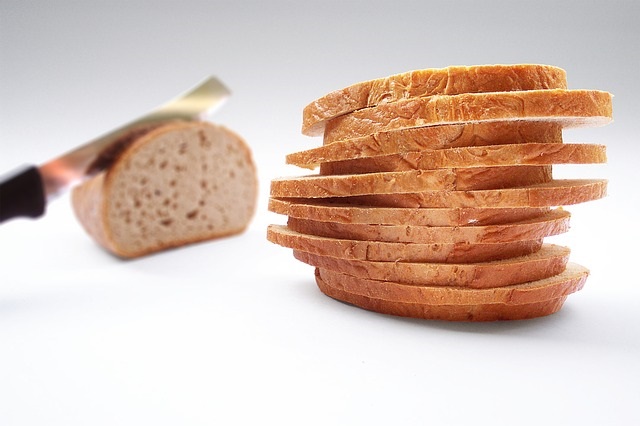

PRESCRIBED-RATE LOANS: BEST THING SINCE SLICED BREAD

Before all this commotion about income splitting and the many ways that corporations, trusts and partnerships could allocate income to lower tax-bracket individuals, there has been in place for quite some time a very simple tool. This tool is known as the prescribed-rate loan. Generally, the income attribution rules under subsection 74.5(2) of the Income […]