Is the family Trust Dead?

IS THE FAMILY TRUST DEAD? Prior to July 18, 2017, one would often hear tax advisors recommending the implementation of a discretionary family trust to a family owned corporate group structure. As a result of the 2017 tax proposals, the full implementation of the Tax-On-Split-Income (“TOSI”) rules, effective as of January 1, 2018, has curtailed […]

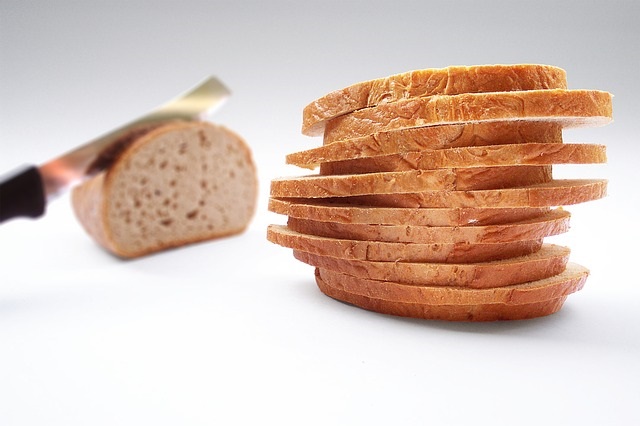

PRESCRIBED-RATE LOANS: BEST THING SINCE SLICED BREAD

Before all this commotion about income splitting and the many ways that corporations, trusts and partnerships could allocate income to lower tax-bracket individuals, there has been in place for quite some time a very simple tool. This tool is known as the prescribed-rate loan. Generally, the income attribution rules under subsection 74.5(2) of the Income […]